OIS10-benchmark: I am watching this very closely, the spread widening indicates counter-party and liquidity risks elevating for 10y notes in the overnight swap market

Tuesday, April 26, 2022

OIS10-benchmark

75 bp hike

I know it's anecdotal but you’ve probably followed the shifting expectations last week towards one and possibly two 75 bp hikes by the Fed. This possibility is getting dismissed because well…that would be the first since…1994. And who was the first to have invoked 1994 in January as a framework for this year?

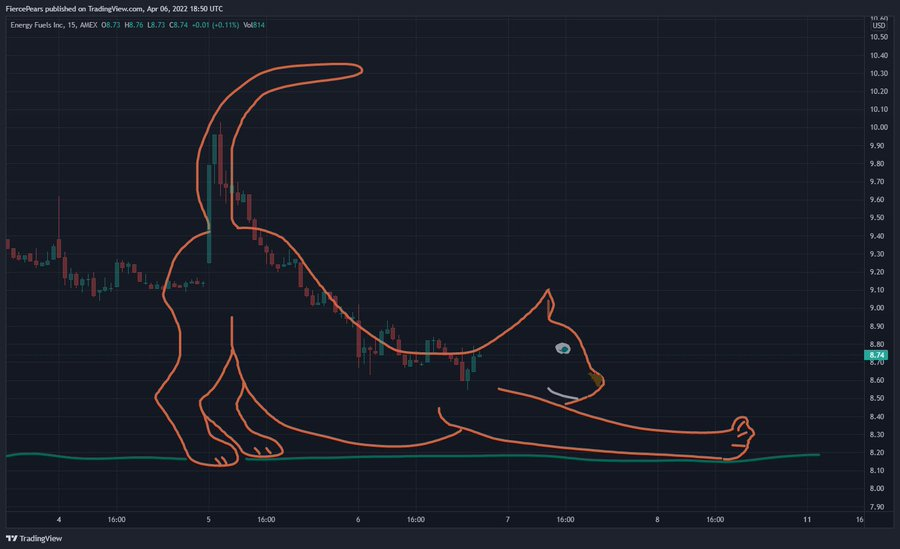

Friday, April 8, 2022

Some outlook on the markets

Balance sheet runoff

The $60 bn roll-off is hardly quicker than the last cycle which has a $50 bn cap - that’s a very dovish QT there - eq market should rally on the back of this - rates could see some relief rally they need it

So think about it in 2 separate buckets: 1- treasuries 2- MBS Compare 1 to last round and for 2 measure delta to run-off Right now they are just delivering run-off which is hardly quicker than last time on 1 and as expected on MBS. No hawkish tilt. I know it's easy to say in retrospect, but the markets trolled them.

Math error

I'm not a math major or anything, but 2022 will see 200 bp of total FFR hikes. QT is $ 0.5 t. There is a spectrum of views on the QT effect. But Fed’s own calculation shows a muted effect in order of few bp per 1 t of QT. More balanced could be 20 bp. Nothing near the below.

Fed QT

I speculate Fed knows and is voluntarily limiting the amount of QT in this cycle. If they really wanted to cut B/S they would have used the available window, maybe 18 months, to do a larger take-down. They are going to end up with a $1.5 t take-down and then back…UP

USD/EURO

I'm sure y'all heard about the euro falling below the dollar for the first time in decades. A "strong dollar" serves great...

-

Good morning, just a friendly reminder that the US 10Y is at 2.699%